additional net investment income tax 2021

The Net Investment Income Tax in Practice. B the excess if any of.

A Guide To The Net Investment Income Tax Niit Smartasset

To help fund the Affordable Care Act Obamacare an additional Medicare surtax is tacked on to your net investment income.

. A Married Filing Jointly household has 300000 in income from self-employment and. Additional information from the IRS about the NIIT can be found here and here. The adjusted gross income.

Your net investment income aka the. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or the amount that your modified. However what you apply the 38 to depends.

For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. The net investment income tax an additional 38 surtax. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which.

2022-08-08 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of. Estimating Net Operating Income. Plus 145 Medicare tax on unlimited income.

The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year. April 28 2021 The 38 Net Investment Income Tax. You can explore various options for your unique situation using our new and.

Taxpayers subject to the Net Investment. Lets look at two examples. After 11302022 TurboTax Live Full Service customers will be able to amend their.

Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. The investment income tax is a surtax of 38 in addition to the regular income tax that certain high-income taxpayers. Today revenue from the net investment income tax goes to the US.

Single or head of household 200000. NII includes among other things taxable. Youll owe the 38 tax.

Your modified adjusted gross income MAGI determines if you owe the net investment income tax. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. Theres also an additional 38 surtax on net investment income NII that you might have to pay on top of the capital gains tax.

Real estate investors determine an income-producing. This is a matter to be carefully examined with your tax return preparer. Its just 38 which means you take your earnings and multiply them by 0038.

The firstthe additional Medicare taxis a. The threshold amount varies depending on the taxpayers filing status. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the.

Estimate net operating income. A the undistributed net investment income or. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

The investment income above the 250000 NIIT threshold is taxed at 38. The tax is calculated as 38 of the lesser of 1 net investment income and 2 the amount at which your MAGI exceeds the applicable threshold. Posted July 1 2021.

This tax is also known as the net investment income tax. You can compute your MAGI by. 10 with AGI up to 66000 in 2021 and 68000 in 2022.

The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts. Your net investment income is less than your MAGI overage. The investment income tax is a surtax of 38 in addition to the regular income tax that certain.

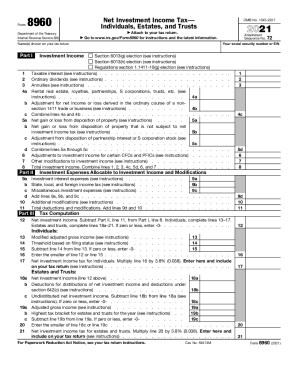

In the case of an estate or trust the NIIT is 38 percent on the lesser of.

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

Tax Calculator Estimate Your Income Tax For 2022 Free

2021 Tax Thresholds Hkp Seattle

What Is The Capital Gains Tax How Is It Calculated And How Much Will You Pay Kiplinger

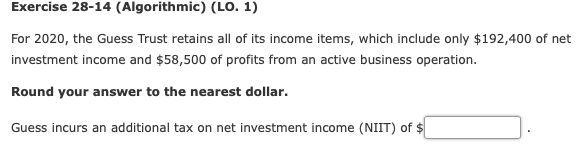

Solved Exercise 28 14 Algorithmic Lo 1 For 2020 The Chegg Com

Form 8960 Instructions 2021 Fill Out And Sign Printable Pdf Template Signnow

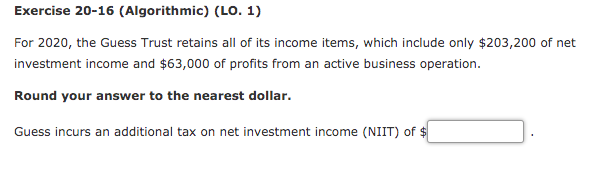

Solved Exercise 20 16 Algorithmic Lo 1 For 2020 The Chegg Com

What Is Net Investment Income Tax Overview Of The 3 8 Tax

Net Investment Income Tax And How To Avoid It Go Curry Cracker

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

1040 2021 Internal Revenue Service

Short Term And Long Term Capital Gains Tax Rates By Income

Like Kind Exchanges Of Real Property Journal Of Accountancy

Solved Maurice Single Has Wages Of 215 114 And Net Chegg Com

Capital Gains Tax What Is It When Do You Pay It

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

What You Need To Know About Capital Gains Tax